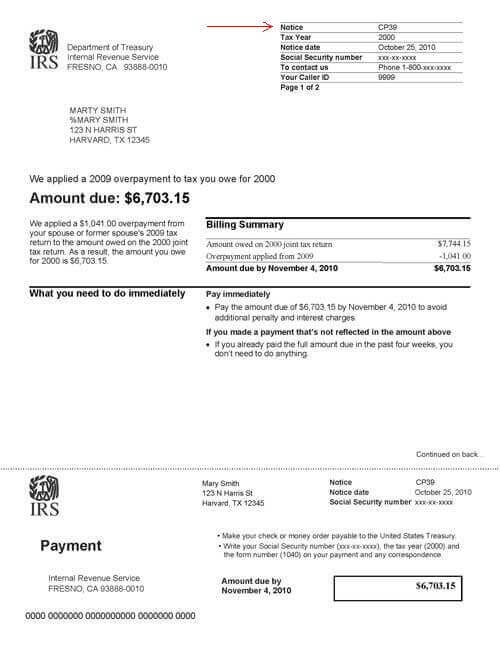

IRS Notice CP39 states, "We applied a [$amount] overpayment to tax you owe for [year]" or "We applied a [year] overpayment to tax you owe for [year]". The IRS uses Notice CP39 to inform you they have taken your spouse's or ex-spouse's refund to be applied to other taxes. This may be a surprise to many people who weren't aware of the problem or its effects.

Investigate

It is obvious the IRS believes you owe the taxes. Yet, often no tax is due. So, it is important to investigate your specific case before reacting! The IRS may also use Notice CP42 to inform you about the seizure.

If the IRS took your current spouse's refund it is a concern. But, if they took your ex-spouse's refund towards your joint debt maybe you don't care.

Refunds are often taken for the debt of a spouse or ex-spouse. Your reaction might be to file an Innocent Spouse claim, an Injured Spouse Claim (Form 8379) or request a state divorce court adjustment. The IRS isn't the only place where you can seek justice. Most likely, the only reason why this remains a problem is because the tax remains unpaid.

Take Action

So, if applicable, you could file Form 8857 requesting relief from the joint liability of the tax debt. Or, if a divorce was involved, you could pursue contempt of court charges in state court for disobeying a court order (if applicable). Or less aggressively, you and your ex-spouse could equitably arrange where one spouse pays the other and/or the taxes to dissolve the IRS action.

But, at the least, to prevent any further refunds from being seized make sure you don't overpay your current taxes by using Form W-4 to adjust your withholding. We need to investigate your case and prepare an Action Plan for you. You only have two years to retrieve any refunds you are due and only two years to recover any refunds taken.

TaxHelpLaw repairs the old and new taxes to get refunds when due! Please follow the IRS Notice CP-39 Prep Steps and see Mr. Hopkins in Colorado Springs or Pueblo before proceeding!

Various IRS Notices CP39: